What do Volkswagen, Samsung and Nike have in common? Apart from the fact that these are all large multi-national corporations (MNCs), what is perhaps lesser known is that these companies have in the past been described as family-owned businesses to varying degrees. Described as a “peculiar hybrid of family business, state-owned enterprise and public company”, Volkswagen was in the news in 2015 when one of the grandchildren of its founder was ousted from the chairmanship of the VW Group after a row with the rest of the supervisory board.

Managing a small family business can be a tricky thing, as mixing private and work life has the potential to bring about either a successful family empire or a long-running family feud. Here, we outline four considerations for managing the legal needs of your family business that will prime your business for success so that it can be passed on to the next generation:

1. Establish a formal business structure and proper corporate governance

While your business may have started out as a casual arrangement between you and another family member, the lack of a clearly thought out business structure and ownership options can threaten your business when disagreements arise during decision-making regarding the business. It is thus crucial to put in place a formal business structure and clear governance practices as your business starts to mature.

If you are still in the early stages of your business idea, head over to our post on how to choose the right business structure when starting up. Whether you choose to start your business as a sole proprietorship, partnership or a company, what is important is that you consider your various options and collectively make a deliberate choice with your other family business partners.

Your choice of business structure has a significant impact on your legal rights and obligations both as an individual and as a business, as well as on the relationships within your family. For instance, incorporating your business as a private limited company would require you to put in place certain corporate governance practices that includes holding regular meetings of the board of directors, filing financial statements by fixed deadlines, and so on.

If you have chosen to incorporate as a company, a legal document that you need to have in place is the Shareholders’ Agreement. A Shareholders’ Agreement regulates relations between shareholders of a company and how the business and affairs of a company are run. This helps to mitigate the risk inherent in entering into a business relationship by setting our rules for decision-making (e.g. number of shareholders required to approve certain actions), resolution of disputes between shareholders, and exiting the business.

2. Develop a family employment policy

While family members may be willing to help out in the business on an informal basis, it is best to put in place formal employment policies to ensure that expectations are aligned. Depending on the preferences of the owners of the family business, you may wish to put in place policies regarding the following areas:

- The family member must have employment outside of the company of a minimum duration as a condition to employment;

- The family member should receive a market salary and receive the same treatment as a comparable non-family employee with regard to benefits, training, performance reviews, and termination;

- The family member should report to a non-family member, if possible.

You should have, at the very least, Employment Contracts for your key employees, including family members. The Employment Contract regulates the relationship between your family business and the family members you employ, and ensures there is alignment on matters such as the hours an employee will work, holiday entitlement, and pay.

3. Think about succession planning

Many family businesses fall apart when it comes to making the transition from one generation to the next. It is thus crucial that you keep your eye on the long run and discuss succession for your business before the time comes for you to let go of the reins. While this is not a purely legal consideration, the advice that is often given is to put people into roles based on ability rather than lineage. Running the business with a meritocratic approach is likely to improve performance and help maintain balanced relationships between family member and non-family member employees.

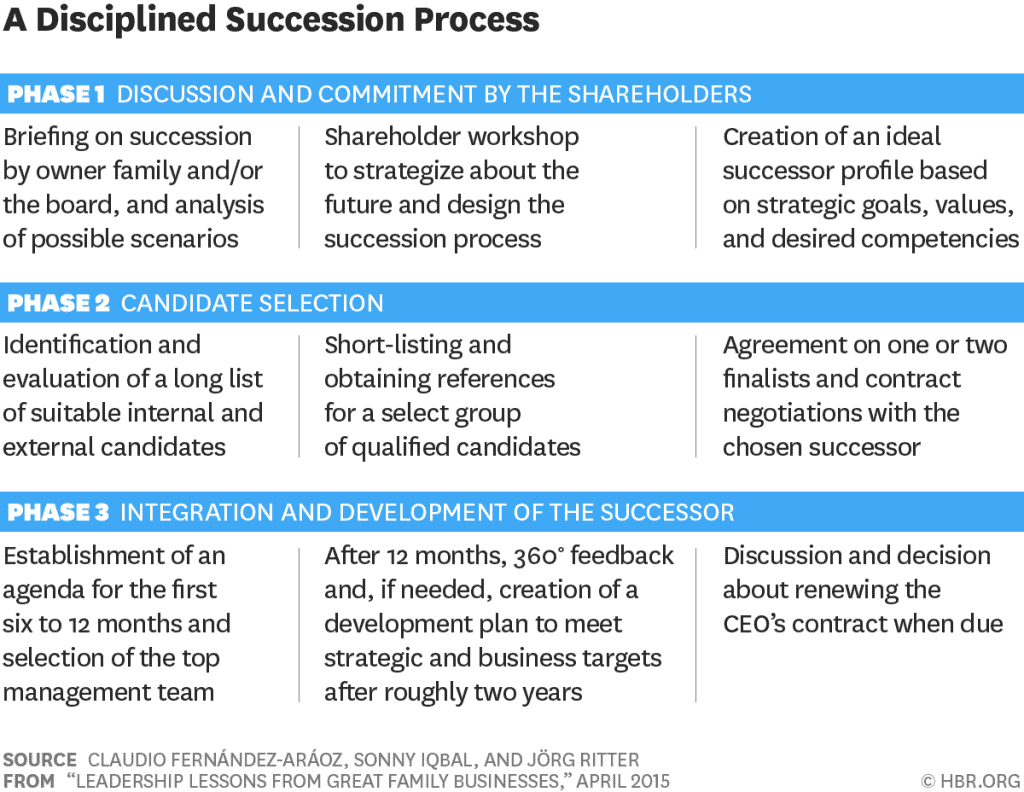

If you intend to select your successor based on a formalised succession process, consider going about the process in organised phases so that you take the interests of the relevant stakeholders – the shareholders, the management, and the candidates themselves – into account.

Source: Harvard Business Review

Conducting a disciplined search involving multiple candidates, even if there is preference given to family members and internal talent over external executives, will lend a sense of professionalism to the process and allow your chosen candidate to be perceived as legitimate when he lands the role.

And whenever someone steps into a leadership role, make sure you formalise the relationship with the proper legal documents. The appointment of a director will require a Director’s Service Agreement, which lays out the rights and obligations that the individual has as a director, above and beyond the rights and obligations he has as an employee. If a senior family member is stepping out of an active day-to-day management role into an advisory role, you may wish to have in place a Non-executive Director’s Letter of Appointment. Alternatively, you can use a Founder Advisor Standard Template (FAST) under which you give the individual the right to receive shares in the future instead of cash compensation. This will lay the foundation for a mutually rewarding relationship between the business and the advisor.

4. Maintain proper documentation and record-keeping

While it is easy to slip into an arrangement where family members run the business based on mutual understanding and unwritten practices, proper documentation and record-keeping is the mark of a professionally-run business. In particular, you should maintain proper records when it comes to business information, financial transactions, and legal documents.

The Zegal web app helps you optimise the process for maintaining proper records and organising your legal documents. With over 200 documents in our document library and a cloud-based storage system where you can store your documents, invite contracting parties to e-sign, and grant access to select employees in your organisation, you will have your legal documentation all in one place, ready to be passed on to the next generation when the time comes.

Claim your free trial. Start drafting legal documents with Zegal today.

Do you have any tips for how to prime a family business for long-term sustainability?

Share with us in the comments below!